Home Mortgages 101: What You Need To Know

Content by-Kragelund PruittWhen you are looking for a home it can be very stressful to everyone involved. More stress is added to the process when you are trying to get approved for a home mortgage in order to purchase your dream home. Don't worry, the following article has many great tips about getting a home mortgage that will help ease this process.

Before trying to get a mortgage approval, find out your credit score. Mortgage lenders can deny a loan when the borrower has a low credit score caused by late payments and other negative credit history. If your credit score is too low to qualify for a mortgage loan, clean up your credit, fix any inaccuracies and make all your payments on time.

Work with your bank to become pre-approved. Pre-approval helps give you an understanding of how much home you can really afford. It'll keep you from wasting time looking at houses that are simply outside of your range. It'll also protect you from overspending and putting yourself in a position where foreclosure could be in your future.

Get your documents ready before you go to a mortgage lender. You should have an idea of the documents they will require, and if you don't, you can ask ahead of time. Most mortgage lenders will want the same documents, so keep them together in a file folder or a neat stack.

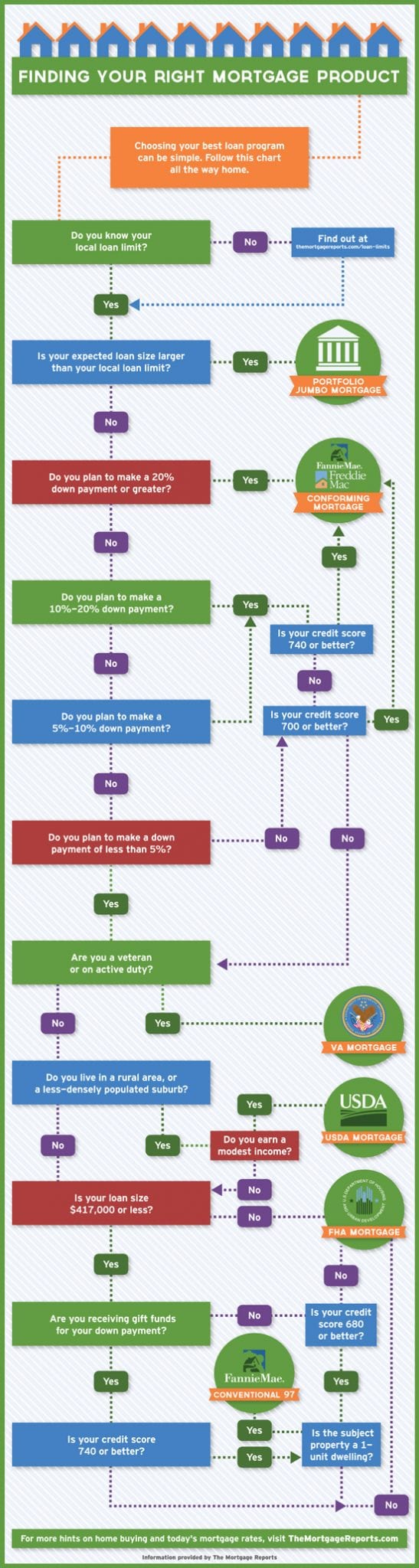

You probably need a down payment. Although zero down payment mortgages were available in the past, most mortgage companies make it a requirement. Find out how much you'll have to pay before applying.

It is a smart idea to reduce your total debt prior to purchasing a home. If there is one payment you never want to skip, it's your home mortgage payment. You will make it much easier if you have minimal debt.

Save your money. When you are going to finance a home mortgage, you will need to have some cash for a down payment. The more money you pay down, the lower your payments and interest rates. The down payment goes directly to the principal of the mortgage and is a sum you will not owe yearly interest on.

New rules under HARP could let you apply for a brand new mortgage, no matter if you owe more than your current home is worth or not. Many homeowners had tried to refinance unsuccessfully until they introduced this program. See how it benefits you with lower rates and better credit.

Do not allow a single denial to get you off course. There are other lenders out there you can apply to. Continue shopping so you can explore all options available to you. You may need a co-signer to get it done, but there is a mortgage option out there for you.

When considering a home mortgage lender, check the lender's record with the Better Business Bureau (BBB). The BBB is an excellent resource for learning what your potential lender's reputation is. Unhappy customers can file a complaint with the BBB, and then the lender gets the opportunity to address the complaint and resolve it.

If you don't have enough money that's saved for your down payment, you should speak with the home's seller to see if they may take back the second so you're able to get a mortgage. In the current slow home sales market, some sellers may be willing to help. You may have to shell out more money each month, but you will be able to get a mortgage loan.

Keep your credit score in good shape by always paying your bills on time. Avoid negative reporting on your score by staying current on all your obligations, even your utility bills. Do take out credit cards at department stores even though you get a discount. You can build a good credit rating by using cards and paying them off every month.

Think about your job security before you think about buying a home. If you sign a mortgage contract you are held to those terms, regardless of the changes that may occur when it comes to your job. For example, if you are laid off, you mortgage will not decrease accordingly, so be sure that you are secure where you are first.

Keep on top of your mortgage application by checking in with your loan manager at least once per week. It only takes one missing piece of paperwork to delay your approval and closing. There may also be https://www.businessreport.com/business/lsu-b1bank-partner-on-veterans-initiative-commercial-banking-scholarship for more information that need to be provided. Don't assume everything is fine if you don't hear from your lender.

Get your credit under control. If you currently have a wallet full of plastic for every occasion, you should downsize. Having too much available credit can harm your loan, even if it is not debt. Close any non-essential accounts. Chose a gas card, a store card, and a single credit card to keep.

You should compare several brokers before applying for a loan. A low interest rate is one major consideration. Also, you need to go over every type of loan that's out there. Think about all the added costs of a home mortgage, such as closing costs and down payment requirements.

Look into a mortgage that requires payment every two weeks as opposed to monthly. This will let you make more payments every year, greatly reducing the amount of money you spend on interest on the life of the loan. This works well if your pay period is every two weeks since the payments can be automatically drawn from your bank.

If visit this weblink want to refinance your mortgage, you will be responsible for closing costs. Do some calculations to see when you will break even. If you do not plan to stay at your house for much longer, it may not be worth your while if you have to pay a lot of fees to refinance.

Being a home owner is quite an accomplishment. However, most people must borrow money to purchase a home. Not knowing enough about mortgages should not keep you from becoming a homeowner. Use the knowledge you learned above to make sure you are on top of the mortgage process.